Taylor Swift and Travis Kelce turned one engagement post into a live scoreboard. The minute that the Instagram announcement hit in August 2025, prediction markets started listing contracts on whether they would be married by a certain year, where the wedding might take place, and how fast the whole thing would happen.

When Taylor Swift's marriage wedding odds are sitting high, and the lobby looks busy, it feels like the wedding is basically locked in. With high prices, plenty of trades, and lots of user activity, it's easy to read that as “this is happening.” What it really shows, however, is that many people care enough to trade—not that the outcome is safer or guaranteed. These Taylor Swift prediction markets on marriage & wedding odds are attention meters, not spoilers.

What Are Taylor Swift and Travis Kelce’s Wedding Odds?

Here are the live odds at Kalshi for Taylor Swift and Travis Kelce's wedding happening before the end of the year:

Event contracts from prediction markets let you trade on questions about Taylor Swift getting married to Travis Kelce and how the wedding will unfold.

Instead of spreads or totals, you see wedding odds tied to questions like whether they are married before a certain date, like Jan 1, 2027, or whether the ceremony lands in a June window that fits around the NFL schedule and a tour break.

Each question is its own market. You buy Yes-or-No contracts that pay a fixed amount if the event occurs under the posted rules and pay nothing if it doesn't. Prices move when new, credible information about their relationship becomes public. Fluctuations may even happen when Swifties decide something is a “sign” about where the relationship is heading.

Price, Implied Probability, and Settlement

In these Taylor Swift markets, “price” is what users are willing to pay for a contract at that moment.

On Kalshi and Polymarket, prices are displayed in cents per dollar. Meaning that if a Yes contract trades at 89¢, people are paying 89¢ for the chance to receive $ 1 if the wedding happens under the rules. That roughly maps to an implied probability of about 89%, with some wiggle room for fees and the bid-ask spread.

One of the headline markets on Kalshi is framed as “Will Taylor Swift and Travis Kelce be married before Jan 1, 2027?”, where Yes has spent time in the high eighties and No in the low teens. That looks confident, but it's still just where buyers and sellers landed after reading the same news cycle, not some hidden model that can see into the future.

Settlement is what actually decides whether those contracts pay. A wedding market like this one resolves only when a clear, public outcome matches the posted rules. A "yes" settlement may require an official announcement from Taylor, Travis, or their representatives,. Alternatively, widespread reporting and visible evidence that the wedding took place at a specific time and place could do the trick.

Rumors, blind items, or “my friend heard from someone who worked an event” might nudge the line, but they don't settle the market.

Are Taylor Swift’s Wedding Prediction Markets Liquid?

Since the engagement news, Taylor Swift wedding markets have stayed active. You open the Taylor tab, pull up a marriage-by-date contract, and there's almost always a live price and someone on the other side. Most days, it feels easy to get in or out of a Taylor Swift & Travis Kelce marriage market.

Fan Activity Inflates Trading

Taylor’s life is perfect fuel for prediction. One Instagram photo with the ring front and center, one clip on the New Heights podcast, one quote hinting at a June ceremony, and you can watch Taylor Swift marriage wedding odds jump in real time. Volume spikes, the Yes side gets hit over and over, and anyone who was early on that contract suddenly has room to sell out.

The catch is that this rush is mostly fan energy reacting to the same piece of news. Fan activity is what boosts trading volume in these markets, not secret information about what will actually happen with the wedding timeline.

Liquidity ≠ Accuracy

Liquidity and accuracy are two different components, even when you're staring at the same Taylor Swift wedding board.

Liquidity is how easily a contract can be traded without a poor fill. If you can hit a Taylor Swift wedding market, post a normal-sized order, and find someone on the other side almost instantly, liquidity is doing its job.

Accuracy is how closely those wedding odds match what actually happens in real life. Do the prices on the screen match the chance that Taylor Swift and Travis Kelce end up married on that specific timeline, in that specific place, under those written rules? No one knows for sure, and since the plans and conversations that decide that outcome aren't public, they can change more than once in a year.

That's why these types of odds can trade smoothly at 80% or 90% for months and still finish on No if the couple pushes the ceremony back or changes the plan entirely. The prediction market can feel calm and liquid while it's quietly lining up on the wrong side of what actually happens.

In other words, liquidity is about ease of trading without big jumps in price, driven by activity and participation from Swifties, NFL fans, and prediction diehards. On the other hand, accuracy is about how well those same odds track real life.

Why Do People Confuse Liquidity vs. Accuracy?

When you open Taylor Swift & Travis Kelce prediction markets and see steady prices with big volume totals, it feels like the crowd already solved the puzzle. Screens look calm, odds barely move, there's always someone willing to trade. But what you're mostly seeing there is attention, not certainty.

Taylor Swift is everywhere, Travis Kelce is on TV constantly, and every new quote or photo gets treated as a sign. That steady interest keeps liquidity high and makes the odds look settled, even when the real chance of the wedding happening on that exact timeline is a lot fuzzier.

Taylor Swift’s Wedding Prediction Markets: Volume & Liquidity?

Volume and liquidity usually move in the same direction on Taylor Swift wedding odds, but they're not the same stat.

Volume is the running total of every Yes and No contract that has traded since the market opened. That's why some Taylor Swift pages show six figures of action even on a quiet Tuesday. You're looking at the full history, not just today.

Liquidity is the “right now” piece. In practice, it's the difference between being able to slip a few contracts into the book at the current odds, or watching the line jump a few cents the second you click.

High Volume, Low Liquidity

High volume, low liquidity shows up when most Taylor Swift traders pile into the same side of a contract. A lot of Yes and No contracts have traded overall, but there's not much depth waiting at the current price. On the screen, that looks like big volume totals, orders flying in for one side, very few users willing to stand on the other side, and even a modest order pushing the odds several cents. From a distance, the market looks busy. From inside the order book, it feels jumpy and thin.

This usually happens right after a strong piece of news or a viral post, when attention moves faster than fresh orders can balance it out.

High Liquidity (Often With Volume, but Not Always)

High liquidity on these wedding markets has a different feel. When liquidity is strong, prices drift instead of jumping. Fresh news hits and the odds adjust in small steps, so you can buy or sell near the posted number and the fill you get still looks like the price you saw when you clicked.

You can usually see that when there's a split in opinion. Some people are sure Taylor Swift and Travis Kelce will be married long before 2027, others think the schedule, the tour, or normal life will push things out. When both views show up with money behind them, you get a band of orders around the current odds and the prediction trades smoothly, even if the headline volume is not huge.

Where Taylor Swift’s Marriage & Wedding Prediction Markets Are Traded

If you're tracking Taylor Swift's marriage wedding odds, you will keep bumping into the same two names: Kalshi and Polymarket. That's where most of the action on this story sits right now.

On Kalshi, everything runs through regulated event contracts. You see straightforward questions about whether Taylor Swift and Travis Kelce are married by a certain date, plus a few other wedding-related markets tied to timing or broad details that lean on the same basic marriage outcome.

Polymarket takes the same prediction idea and puts it on a crypto rail. The Taylor Swift boards sit alongside politics, sports, and other culture markets, and users treat her relationship with Travis almost like another season-long narrative to trade.

rg

Taylor Swift Marriage & Wedding Markets on Kalshi

On Kalshi, these markets are structured as clean Yes-or-No contracts on specific questions, with results settled once real life catches up.

Here's a snapshot of the core Taylor Swift wedding market and how it has been priced and traded:

|

Market |

Latest Price Shown (Yes) |

Latest Price Shown (No) |

Volume |

|---|---|---|---|

|

Will Taylor Swift and Travis Kelce be married before Jan 1, 2027? |

88¢ |

16¢ |

$90,738 |

|

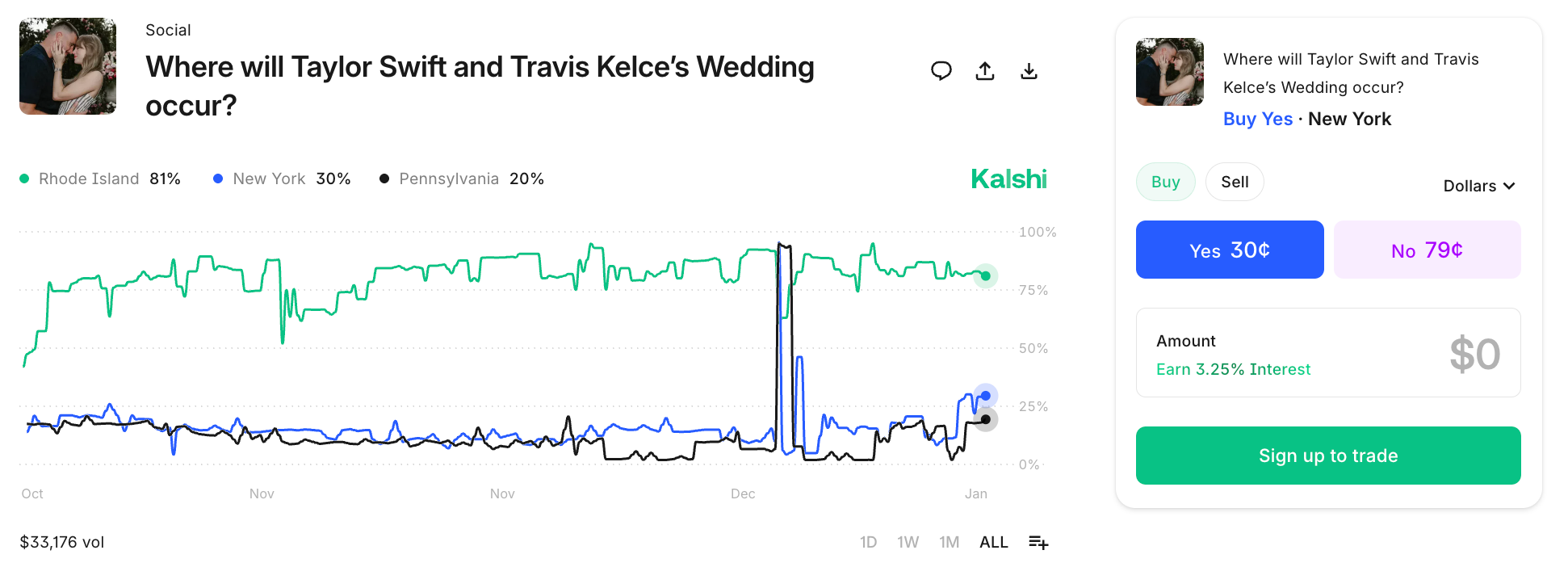

Where will Taylor Swift and Travis Kelce’s Wedding occur?* |

84¢ |

22¢ |

$34,315 |

*For multi-outcome markets like “Where will the wedding occur,” these prices reflect one of the leading individual contracts at the time of writing, not every location listed on the board.

Read Next: See how marriage odds impact the odds of Taylor Swift's wedding party

Taylor Swift Marriage & Wedding Markets on Polymarket

Polymarket runs its Taylor Swift prediction markets in a similar event-contract format, settled on chain.

Here's a look at one of the Swift and Travis Kelce wedding-timing markets there:

|

Market |

Latest Price Shown (Yes) |

Latest Price Shown (No) |

Volume |

|---|---|---|---|

|

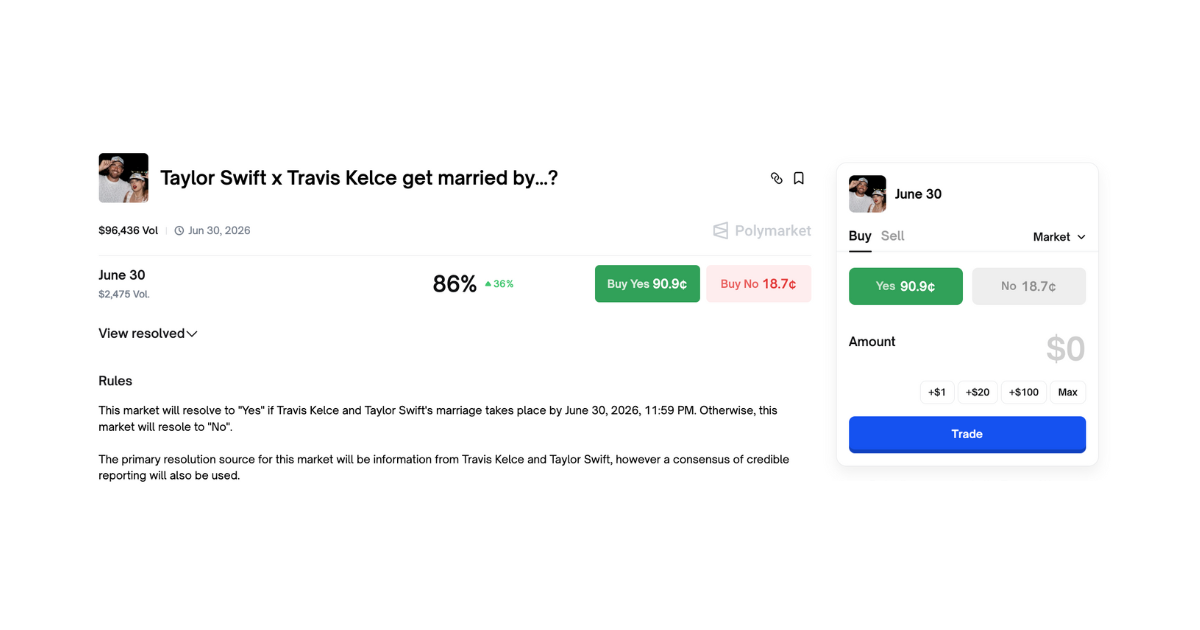

Taylor Swift x Travis Kelce get married by June 30? |

83¢ |

46.9¢ |

$98,835 |

This marriage-by-June-30 contract is a good example of how traders slice the relationship into specific wedding timelines. Other Taylor Swift markets on the site push the deadline out further, but they're all just live prices that move with the narrative, not a fixed script for how the wedding has to happen.

Learn More: How to Bet on Kalshi

Taylor Swift's marriage and wedding odds are priced in prediction markets on whether she and Travis Kelce get married by certain dates or under specific conditions. Those odds reflect what people are paying for Yes-or-No contracts, not a guarantee that the wedding actually happens on that exact timeline.

Taylor Swift's wedding odds move so often because every new piece of news, photo, or Instagram post gives traders something to react to. When Swifties and Travis Kelce fans update their views in real time, the market keeps changing the chance that the wedding happens by that contract’s deadline.

High volume in Taylor Swift prediction markets means many contracts have traded on that wedding question over the life of the market. It tells you plenty of users care about the outcome, but high volume alone doesn't prove today’s wedding odds are accurate.

Taylor Swift's wedding prediction markets are liquid because there are usually enough people on both sides who want to trade on her relationship with Travis Kelce. That steady flow of orders makes it easier to get in and out near the listed price, even if the prediction on when they get married still ends up wrong.

Users can find Taylor Swift prediction markets on exchanges like Kalshi and crypto platforms like Polymarket, depending on what's available in their region. Each website posts its own markets with specific rules and timelines, so it's worth reading the description and rules before you trade anything.