NBA Top Shot CEO Responds to Concerns, Addresses What’s Next for Digital Card Company

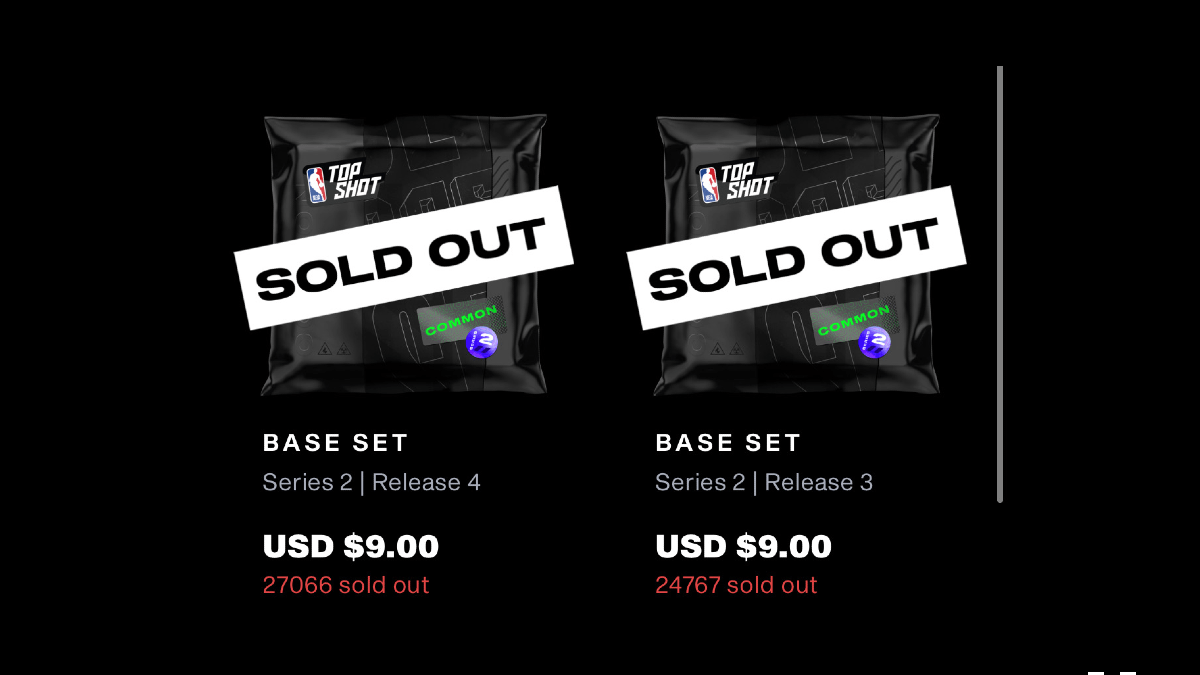

Via NBA Top Shot. Packs run from $9 to $230.

It’s hard for anything these days to surpass the heat and momentum around basketball cards and yet, there is one product in collecting that, over the last month, has: Digital basketball cards.

NBA Top Shot, which gives collectors packs of highlights instead of cardboard, is on fire. In the last four months, the company has sold $11 million in packs, but the highlights in those packs – call them digital cards – have traded on the marketplace for more than $70 million in the last month alone, including a couple highlights that have sold for $100,000 each.

The company behind Top Shot is Dapper Labs, an offshoot of the company that developed Crypto Kitties, which, before Top Shot, was the most successful digital collectible tied to the blockchain.

In fact, Crypto Kitties was so successful it stressed the Ethereum, the cryptocurrency it was built on. So Dapper built its own blockchain, Flow, to support its collectibles pipeline that started with Top Shot, but is slated to include collectible highlights from other sports leagues.

“We’re not trying to do any big speculative thing,” said Dapper CEO Roham Gharegozlou in an interview with The Action Network this week. “We are trying to build something for the long term and those big numbers get the headlines, but a majority of Top Shot transactions are…less than 50 bucks. And that’s what makes Top Shot special. It brings the act of opening trading cards, trading with your friends with no friction.”

No friction into today’s marketplace is very appealing – especially since the act of pulling a piece of cardboard out of a pack involves getting it graded by one company and posting it for sale somewhere else.

The growth is not by accident. From the very beginning, Gharegozlou and his team have tried to encourage mass adoption of Top Shot by playing down the tech behind the product. While mentioning that each encrypted highlight is guaranteed to be owned by that person without duplication and secure, this digital collectible, unlike the others before it, can be bought with a credit card and sold for real cash, which means the buyer never has to own a piece of cryptocurrency.

“I try not to talk about the blockchain part,” Gharegozlou said. “I say what you need to be good at NBA Top Shot is basketball knowledge, you need trading card knowledge and you need to know sort of what’s going to be valued by collectors. You don’t need to understand anything about crypto or blockchain. Most of our users are coming in as credit card users. They aren’t crypto currency users and that’s sort of what we like about it.”

That’s the genius of the product, says Drew Austin, founder of Red Beard Ventures, which has invested in the digital collectibles company space, including SuperRare and Dapper Labs.

“It’s so much more scalable,” said Austin, who personally spent $75,000 on Top Shot moments that he says are now worth more than $1 million on the open market.

While initial skepticism from the masses came from physical card collectors because Top Shot is digital and not physical, Top Shot is helped by the fact that the collectors marketplace is changing. People are storing their cards in vaults in different states or buying cards and memorabilia fractionally, without ever seeing what they own, through Starstock and Rally.

Initial barriers are also falling. Sure, you don’t own the highlight you buy and don’t get any dividend, but you don’t own the photo on a basketball card either. As to the criticism that a particular highlight isn’t worth what is being paid for it, how is it different from a card? Is the photo on Hank Aaron’s 1954 Topps rookie card that amazing?

Plus, the physical and digital worlds started to mix this week, as two auction houses, Heritage and Goldin Auctions, posted auctions of Top Shot moments.

"There's so much potential for collaboration or drops that cross over physical and digital memorabilia," Gharegozlou said. "We did a Christie's auction back in 2018 for a Crypto Kitty. It’s impossible in 2021 to bet against digital and I think people are starting to understand that."

Despite aggressive growth plans, the company has been surprised by the response. Collectors have been so eager to buy packs, which have ranged from $7 to $999, that the website has crashed consistently, forcing the company to be open to the community about performing stress tests. A release of 50,000 packs at $14 each on Monday was delayed twice, as 40,000 people waited in line, because of the demand.

A boffo funding round is in the works to build the company — already backed by crypto believers Andreesen Horwitz and Fred Wilson — which in recent weeks has outsourced a lot more help.

Among the issues users have complained about is withdrawing money. That comes down to the company growing so fast. It’s why, despite growing to more than 50,000 users, the company is still technically in beta stage.

"People are not patient, but I get it," Gharegozlou said. "This is people’s money. We respect that…We are doing our best in terms of messaging."

Gharegozlou told The Action Network this week that Dapper’s head of product was also in charge of executing the company’s fraud checks, which has to be done when money is withdrawn. Now, the fraud department consists of five people.

Other growing pains include pressure on Gharegozlou to answer questions about why he owns so many highlights that are now worth approximately $5 million on the open market.

Gharegozlou responds by saying there’s no intention to deceive – his username is Roham. But he, as well as all the company executives, had to use the product in order to make sure it worked. While packs today sell out immediately, a couple months ago, packs would remain on the site for days, he said. His response on the value of what he has or concerns about giving himself loaded packs, is that he is willing to make a promise to collectors.

"I consider it like Satoshi's wallet," said Gharegozlou, referring to the pseudonym used by the person who invented bitcoin." I don’t plan on selling anything ever.

While the blockchain promises to be around forever and therefore concerns about how long the deal is with the NBA might not be material to some, Gharegozlou understands the want for transparency.

"I want to work with the league to announce it," Gharegozlou said of the deal terms, which are currently confidential. "I think it's totally valid for people to know…But the point of them being on the blockchain is that worst case, let's say Dapper Labs says next year 'We're just gonna work with the NFL, we don't want to do basketball.' Well, then the NBA can spin off an NBA Top Shot by themselves or go with another developer and they can essentially honor the past collectors assets."

So what's next in NBA Top Shot?

Well, aside from one "Run It Back" pack, which featured highlights from 2013, all the highlights offered have been from the 2019-20 or 20-21 season.

The first highlights that were minted by Dapper were actually 150 1-of-1 highlights and there are 1-of-3 highlights ready to go again. On the 1-of-3, Gharegozlous says he'd like to give the starring player in each of those highlights the rights to one of them, so it would effectively become a 1-of-2.

These projects will be held back until the company is out of beta, Gharegozlou said, which could be more than six months.

Check out our NBA odds for insights and updates during the 2021-22 NBA season.

How would you rate this article?