Sports Betting Promos to Change as Costs Rise for Operators

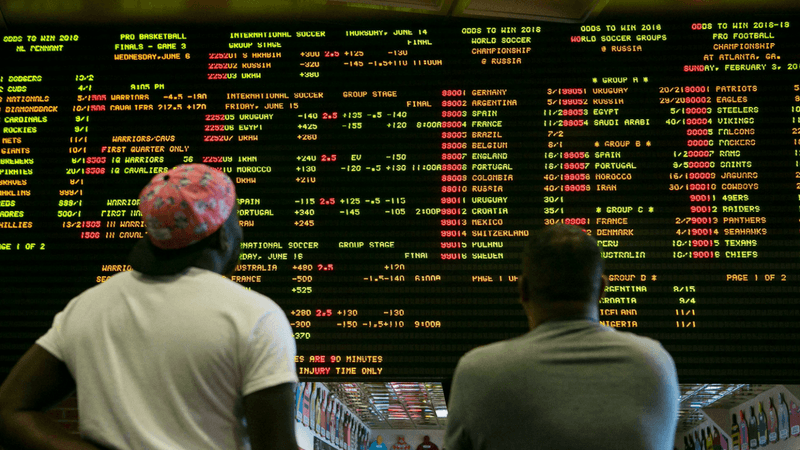

Suchat Pederson/The News Journal via USA TODAY NETWORK, Pictured: Delaware sportsbook

The promos Americans have grown used to in their four years of legal sports betting are on the verge of major changes.

Between the growing sophistication of U.S. bettors and more states beginning to tax them, promos are becoming increasingly costly for sportsbooks. As they face increased pressure to turn a profit, many are cutting back on promo spending.

Larger-scale promos are disappearing in states where promo abuse has run rampant. More promos are expected to disappear by the end of the year.

“The terms and conditions on a lot of promos out there run through 2022, so in most jurisdictions, if the companies even wanted to, they couldn’t get out of what they've been offering," Steve Astrachan, former Marketing Director at PointsBet said. “You’re going to see the promo landscape change considerably going into 2023."

Promo Abuse Surges

Smart bettors look for any advantage they can get, and promos are no different.

Those $1,000 first-deposit matches are all well and fun until bettors like this one tell everyone they can bet both sides of a game with their free deposit and ensure a $1,000 profit.

“One of the first things I heard at PointsBet was 'we could never offer promos like this in Australia because they would get abused so hard that we’d never make a dime,'" Astrachan said. "It doesn't sound that long ago, but it’s been four years in America. Users are getting wiser to promos and taking aggressive measures to make the most out of them."

Notably, Caesars has stopped offering its $3,000 deposit match in New York, which ran rampant with abuse.

"New York's been a great test case, where we've seen operators pull back from some high promos they had offered," Brandt Iden, head of U.S. government affairs at Sportradar, said. "They're realizing it's unsustainable."

Companies like FanDuel have moved from "free credit" to "free bets" to compound the tactic. Those reward winning bettors only their winnings, instead of winnings plus their free stake.

Winning a $1,000 "free bet" would give you $1,000 to withdraw, as opposed to free credit, which would give the $1,000 won plus the $1,000 in credit staked.

Promos were always going to change for companies to become profitable. However, only 21 states are live with legal online betting, meaning the U.S. market is still far from maturity.

Reducing Spending to Please Stockholders

The industry's U.S. strategy has been to acquire as many new customers as possible and worry about profitability later. Promos have been central to that, though for the most part they're funded by stockholders.

With sports betting stocks being as low as they've ever been, operators are dealing with unprecedented pressure to cut costs and show a path toward turning a profit.

"Some shares are down 70 percent year-to-date or since peak, simply because the business is not sustainable. These companies burn an incredible amount of cash, especially on promos," Adam Steffanus, a senior portfolio manager and partner at Advisory Research, said.

Caesars cut promo spend drastically in Q2 of 2022, company executives said during an earnings call last week. They pointed to the strategy as a solution to save hundreds of millions going forward.

"Our marketing teams will have new and enhanced ways to deliver offers and promotions to customers, ensuring that they receive them in the most cost-effective way," Eric Hession, Co-President of Caesars Sports and Online Gaming, said.

MGM Resorts, which operates BetMGM, said in its earnings call losses from its online sportsbook should "further moderate" as promotional spend "rightsizes."

DraftKings executives said more of the same during their earnings call.

Expiration Dates Complicate Matters

Each promo requires sportsbooks to set an expiration date within their terms and conditions.

Many of those — such as BetMGM's $1,000 risk-free bet and PointsBet's $2,000 risk-free bet — expire at the end of 2022, meaning oddsmakers can't stop offering them, even if they want to.

"We ran into it when I was at Fubo," Astrachan said. "We posted something in Arizona and we're thinking we potentially wanted to change it, but we knew we were hamstrung by the expiration date that we put on it.”

It'd be surprising if those expiring offers get renewed in more mature markets without more restrictions — like requiring more play-throughs before withdrawal or shorter expiration dates.

States Increase Costs with Taxes

Enough time has passed for states to get wiser to promos, as well.

Virginia and Colorado both recently enacted changes to make sportsbooks start paying taxes on revenue from promo bets.

They had been among nine states that let sportsbooks deduct that revenue from their taxable income — which the industry has sold as an essential tool to defeat the illegal market.

“It'll be interesting to see how they change what they offer to the patrons as we move forward,” Gina Smith, the Virginia Lottery’s deputy director of gaming compliance, said during a board meeting in July.

Each state's change comes as they've fallen short of tax projections.

Sportsbooks have deducted over $1 billion in revenue from promos across those nine states, equating to roughly $677 million, based on Action Network estimates.

Colorado Sen. Chris Hansen, who sponsored his state's bill, said he expects more states to tax promos, as they study the tax code and realize how much sportsbooks have deducted.

“I understand the need to get market share. I don’t think this will hinder their ability to do that — it just won’t be subsidize by the tax code," he said.

Taxing promo revenue makes it harder to compete with illegal bookies, which offer promos without paying taxes, according to Casey Clark, senior Vice President of the American Gaming Association.

"It inhibits their ability to put forth an appealing product," Clark said.

A tax on promo revenue can increase an effective tax rate by over 50%, according to Adam Hoffer, Director of Excise Tax Policy at the Tax Foundation.

"In New York, where there's a 51% tax, the actual rate is more like 77%," Hoffer said.

New York Assemblyman Gary J. Pretlow has warned sportsbooks won't be able to give incentives for long if they keep getting taxed. He proposed a bill earlier this year to make promos deductible, but it struggled to find supporters, as New York has beat every state in tax revenue.

Iden encouraged states to be patient with the still nascent industry, which is about two years old in Virginia and Colorado.

Maine and Massachusetts, two of the three states to pass sports betting in 2022, will not allow deductions for promos, a trend Hoffer expects to catch on with more states as they legalize.

"If your pure goal is to collect as much tax revenue as possible, then you collect more from including these promos in the tax," Hoffer said. "For the most part, bigger states aren't passing these taxes with bettors in mind. Their duty is to all their constituents."

How would you rate this article?